- Information on the implementation of the Joint Operating Plan of the Government of the Republic of Kazakhstan and the National Bank of the Republic of Kazakhstan to ensure financing of domestic producers and exporters for 2015-2016 in terms of conditional financing as part of support of domestic automakers through second-tier banks:

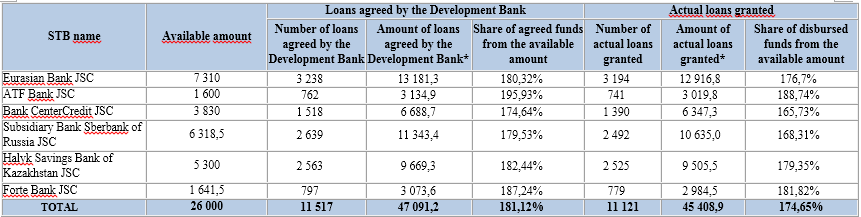

As of Оctober 25, 2018, the Development Bank agreed 11 517 applications of second-tier banks for auto lending for a total of KZT 47 091,2 mln. Therefrom 6 second-tier banks granted 11 121 loans to purchase vehicles of domestic car manufacturers for a total of KZT 45 408,9 mln.

The breakdown of actually agreed and outstanding disbursements for second-tier banks (KZT mln.):

The Development Bank carries out regular monitoring of the development of loan funds allocated from the National Fund by agent banks. In total, under the Program, KZT 26 bln. was allocated from the National Fund for lending to individuals to purchase cars assembled in Kazakhstan.

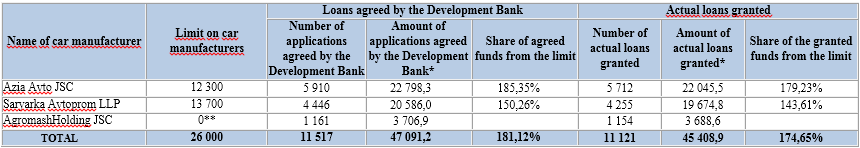

The breakdown of actually outstanding disbursements for car manufacturers (KZT mln.):

** a change in the list of car manufacturers and limits on them was made in accordance with the decision of the State Commission on the issues of Modernization of the economy of the Republic of Kazakhstan.

- Information on the implementation of the financing program of Development Bank of Kazakhstan JSC of domestic car manufacturers at the expense of the republican budget through conditional financing of second-tier banks for lending to individuals - buyers of cars of domestic manufacture:

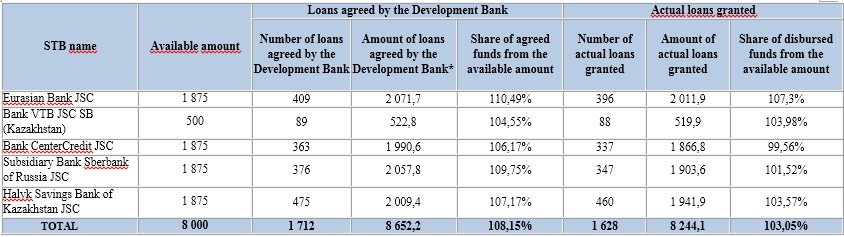

As of Оctober 25, 2018, the Development Bank agreed 1 712 applications of second-tier banks for auto lending for a total of KZT 8 652,2 mln. Therefrom 6 second-tier banks granted 1 628 loans to purchase vehicles of domestic car manufacturers for a total of KZT 8 244,1 mln.

The breakdown of actually agreed and outstanding disbursements for second-tier banks (KZT mln.):

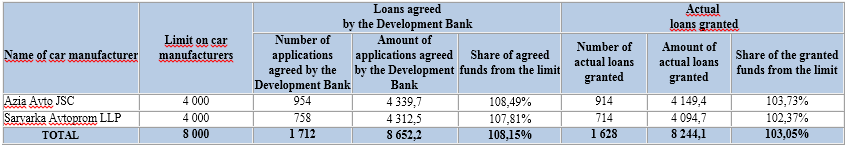

The breakdown of actually outstanding disbursements for car manufacturers (KZT mln.):

DBK is an operator of the Preferential Car Loan Program, which was launched on April 20, 2015. The Bank coordinates the applications received by the DBK from the STBs for compliance with the following financing conditions for end borrowers - domestic car buyers approved by the Decree of the Government of the Republic of Kazakhstan No. 271 of April 23, 2015: the car model of domestic assembly, the maximum cost of 1 car unit, the interest rate, the loan period. The second tier banks are engaged in reviewing, testing of solvency and approving loans of individuals.

Loan conditions to individuals for the purchase of domestic cars, approved by the Government of the RK, are as follows: Nominal interest rate - no more than 4% per annum, while the annual effective rate (including insurance costs and costs for arrangement of motor vehicles in security) should not exceed 7.5% per annum. Loan period - not more than 7 years, loan currency - KZT, cost of one unit of car - no more than KZT 15 mln.

Financing of the Preferential car loan program has a revolving nature. That is, payments from repayment of current loans are again directed to car loans.

End borrowers - individuals are offered 61 car models of such brands as Kia, Chevrolet, Skoda, Hyundai, SsangYong, Peugeot, Toyota, etc., which are assembled at enterprises SaryarkaAvtoProm LLP and AZIA AVTO JSC.